In 1977, Mr. Hasmukhbhai Parekh came up with an idea of opening a finance company called ‘Housing Development Finance Corporation’ Ltd.

The company, in 1994 turned into a private sector bank and was named HDFC Bank Ltd. The journey of the bank was filled with its share of ebb and flows. But the ebbs were not bad enough to knock off the strong pillars of the bank and flows never made the bank complacent enough to stop it from walking beyond the ambit of success.

The starting of the journey

In 1994, the NBFC called ‘Housing Development Finance Corporation’ became the first bank to receive an ‘in-principal’ approval from RBI. Back then, the guidelines and requirements of RBI were different from now. The approval of ‘in-principal’ by RBI made HDFC a part of its liberalization of Indian banking Industry 1994. This was a process granting the license to the bank to proceed with the banking operations. HDFC was the first bank to get this approval and it became a part of RBI’s elite list of Indian lenders. The bank commenced its operations on January 16, 1995. In the same year, HDFC bank launched an initial public offering (IPO) of a whopping Rs500 million.

After that day HDFC bank never looked back and it continued to open gates to new horizons. In the year 2000, HDFC bank merged with Times bank. The banking industry saw its first merger in private sector bank category with the merging of these two banks. In the same year, it also became the first bank in India to launch mobile banking services. Later in the year 2008, the bank acquired the Centurion bank of Punjab for Rs.95.1 billion, making it the largest merger in the sector of finance in India. On November 1, 2012, HDFC bank became the first largest bank by market capitalization.

The bank continued to grow year after year as by the year 2016 the bank distribution network was 4541 branches and 12000 ATMs across the nation. The bank managed to gain all the success and profit because it provided the best facilities a bank must provide. The products and services provided by this bank is customer-friendly which includes wholesale banking, retail banking, personal loans, credit cards, and digital products.

Downfall: A flash in the pan

After seeing its part of prosperity and success, HDFC bank faced a heavy downfall in the year 1995, when a tie-up with a foreign collaborator National Westminster (NatWest) turned out to be the biggest mistake as the NatWest exited the agreement 2 and half years later with huge profits. This collaboration brought no value to the bank.

The bank has however made a very few mistakes in its banking life and it has also learned from it. This makes the bank one of the leading competitors in its sector.

The undefeated pioneer

The graph of the growth of HDFC bank has consistently escalated upwards; seeing minor or no downfalls. The total balance sheet of the bank stands at Rs 895,653 crore and deposits at Rs. 671,376 crore. The non-performing assets are at the lowest possible of 0.4. The success of the bank constitutes 54% of retail loans alone.

When we see the position of private banks in India, we can see how the position of HDFC bank stands unscathed as this bank is too big to fail. This bank is among the top 3 bank which constitutes some part of the GDP of India. Any up or down in the success or growth rate of this bank will also affect the country’s financial and economic system.

Keeping up with technology and CSR

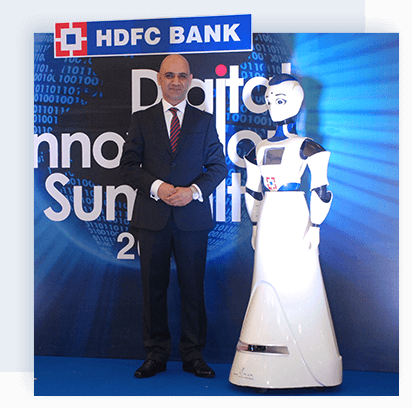

HDFC bank has been welcoming technological advancements with both the hands wide open. HDFC Bank is the first bank to introduce a humanoid (human-like robot) at its welcome desk in Mumbai. The bank has started to venture into a holistic technological journey which will enhance the experience of its customers and at the same time, it will give boost products and services which are technologically driven.

HDFC bank has further introduced an AI-based chatbot called EVA (electronic virtual assistant) which will help customers to get their queries and information quickly. The bot works in association with Google Assistant and Alexa, which will allow customers to book tickets for various services and entertainment. The most loved service is its digital loan facility, which provides the loan in just 10seconds when backed against necessary security. The bank is continuing to give justice to its title of ‘digital bank’.

Corporate social responsibilities (CSR) have been a part of the bank’s growth mission throughout the journey. In 2014, HDFC bank set Guinness world record for putting the largest effort of one of its kind for the annual blood donation drive. Earlier in 1997, the bank banned paper cups and asked its employee to get their cups for drinking tea/coffee.

This rule saved up to Rs.50 lakhs. Other than these little efforts by the bank, it has also shown its part in comprehensive growth of communities in distinct areas like rural development, healthcare, financial literacy and awareness along with donations to many NGOs which have bought impact to lakhs of houses and about 870 villages. The bank managed to implement policies directed by the government like PMAY, MNREGA and many more.

Conclusion

As they say, growth is a collective effort. HDFC bank has managed to outgrow all its competitors in the market which huge margins and it was also successful in surmounting the usual ups and downs of the banking industry without facing much losses or downfalls. The decisions made by the bank have mostly turned out to be successful. The effort towards the implementation of technology and CSR has further added golden feathers to its cap. The main reason behind the success of being the pioneer of successful banking is that the bank has always tried to cater to the best services to its customers and will continue to do so in the coming years.

0 Comments